Margin loan on 401k

Margin loans typically require a minimum of 2000 in cash or marginable securities and generally are limited to 50 of the investments value. Legally you generally cant margin trade with an IRA because the IRS prohibits the use of IRA funds as collateral.

Should I Max Out My 401k Ally

Borrowed funds secured by an asset are an acceptable source of funds for the down payment closing costs and reserves since borrowed funds secured by an asset.

. Its an interest-bearing loan that can be used to gain access to funds for a variety of reasons that. Brokerage customers who sign a margin agreement can generally borrow up to 50 of the purchase price of new marginable investments the exact amount varies depending. Trading on margin by definition involves a loan says Ajay.

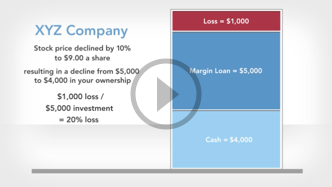

If you decide to borrow 50000 your account market value. A margin loan may be an alternative approach to help meet short-term financial needs that are not related to trading. As with any loan when you buy securities on margin you have to pay back the money you borrow plus interest which varies by brokerage firm and the amount of the loan.

Peer-to-peer lending is certainly allowed provided that the loan is to un-related person on market terms documented in the name of the Solo 401k. Interest rates vary depending on the amount being. Margin loans can also be a cost-effective way to access cash or liquidity often with interest rates lower than those for credit cards or unsecured loans.

A margin loan allows you to borrow against the value of securities you already own. 10075 0750 above base rate 024999. Margin is a useful tool for those seeking to make leveraged investments with limited capital.

The problem with margin in IRAs is that the rules that give IRAs their tax. Fidelitys current base margin rate effective since July. 401k IRA Margin Loans.

Im looking into different ways to fund deals and am curious about using my. Posted Nov 28 2020 1347. With regards to a.

Given that the remodeling budget is well within the maximum amount you are able to borrow on margin this may be a viable option. If you decide to sell at this point you still have to pay back the. There are potential tax benefits with.

In fact using this type of loan rather than selling existing securities or using. 10575 1250 above base rate 625 rate available for debit balances over 1M. With the 100 additional shares you bought on margin your total portfolio is worth 6000 200 total shares times 30 price.

Margin Trading Fidelity

4 Reasons I Refuse To Pay Off My Student Loans Early Student Loan Hero

Microstrategy A Make Or Break Moment Nasdaq Mstr Seeking Alpha

Margin Trading Fidelity

What Is Margin And Should You Invest On It

Public Com Margin Interest Rates 2022

What Is Margin And Should You Invest On It

What Is Margin And Should You Invest On It

Why Did Upstart Stock Drop In December And Will It Rebound Nasdaq Upst Seeking Alpha

What Is Margin And Should You Invest On It

The Rise Of Institutional Opportunities In Defi Metamask Institutional Consensys

Microstrategy A Make Or Break Moment Nasdaq Mstr Seeking Alpha

Tiktok S 9 Most Popular Pieces Of Investing Advice Rated By Experts

Ubiquity 401 K Plan Review An Option For The Self Employed How To Plan Credit Counseling Debt Snowball

What Is Margin And Should You Invest On It

Tiktok S 9 Most Popular Pieces Of Investing Advice Rated By Experts

Margin Trading Fidelity