Federal disability retirement calculator

Only distributions are taxed as ordinary income in retirement during which retirees most likely fall within a lower tax bracket. Federal Employees Retirement System FERS The Federal Employees Retirement System FERS was established by Public Law 99-335 in Chapter 84 of title 5 US.

Can You Work While On Federal Disability Retirement Harris Federal

View fact sheets for all Federal Benefits available to Soldiers and Families sorted by Category by Component by Life Event and listed alphabetically.

. Certain other Federal employees not covered by FERS have the. OPMs Denial Strategy The Process and 5 Questions to Ask Yourself The Postal Service Today. OPMgov Main Retirement Calculators Federal Tax Withholding Calculator.

You can access the calculator two ways. Some follow the federal rules for determining if benefits are taxable others have their own sets of deductions and exemptions based on age or income and Colorado Nebraska New Mexico and West Virginia are. Federal Income Tax Calculator 2022 federal income tax calculator.

Most military retirement pay is treated and taxed as normal income but in certain cases it can be excluded. You are invited to read the articles I have recently written concerning various aspects of the Federal Employee Disability Retirement process in the following websites. And the Supplement is unique to FERS there is no counterpart to the Supplement in the Civil Service Retirement System CSRS.

Eligibility for any benefit or service is based on current Army DoD andor VA regulation. How much retirement income may my 401k provide. A Paradigm for The Future Federal Disability Retirement.

Civil Service Retirement. Are my current retirement savings sufficient. Retirement pay in this case begins after the military members final out processing.

We assume that your income in the future increases by the rate if inflation and your income in the past is discounted by the same inflation rate Indexed Earnings. We use the Social Security Administrations National Average Wage Index to index wages for the social security benefit calculation Working Years. OPM has information to help you.

The Federal Employees Retirement System FERS was established effective January 1 1987. Join the thousands of federal employees who trust us to guide them in their retirement planning journey because of our unique perspective of how your FERS benefits. When should I begin saving for retirement.

Social security retirement income estimator. Lets take an example. Code and effective January 1 1987.

Jerry a CSRS-covered employee retired from federal service with 40 years of service on January 1 2022. Active component retirementavailable to those who have completed 20 years of military service. View our webinar Your.

A postponed retirement means that you are fully eligible for an immediate MRA 10 retirement annuity but you elect to delay the retirement to reduce or eliminate the age reduction. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. The second requirement is that you must have a normal immediate retirement not an early retirement MRA10.

FERS retirement eligibility is based on years of service and minimum retirement age MRA. All Federal civilian employees hired after this date are covered under FERS. Remember disability retirement is a benefit which you as a Federal or Postal employee earned after 18 months for FERS or 5 years for CSRS of Federal service.

Im retired how long will my savings last. Taxes are unavoidable and without planning the annual tax liability can be very uncertain. Use that information to update your income tax withholding elections on our Services Online retirement tool.

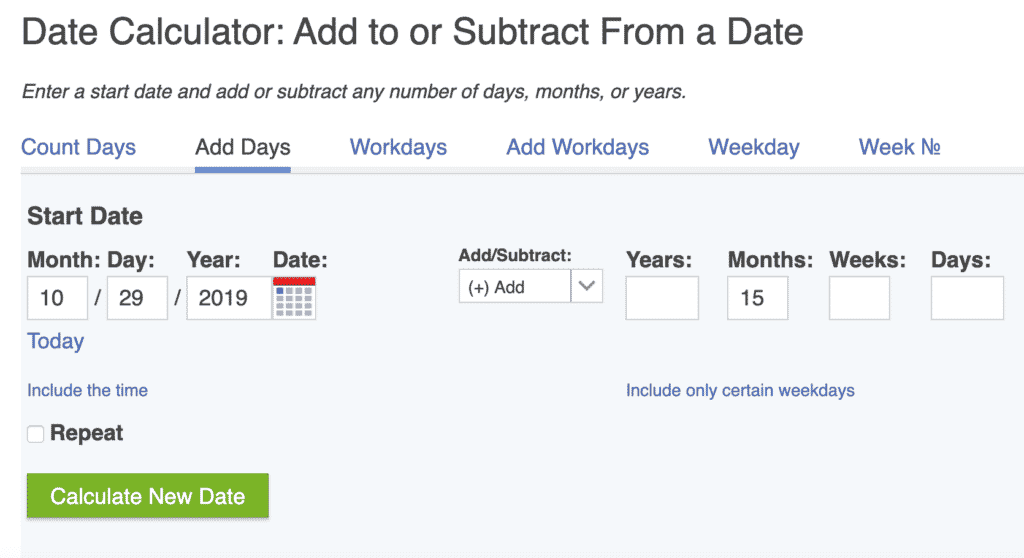

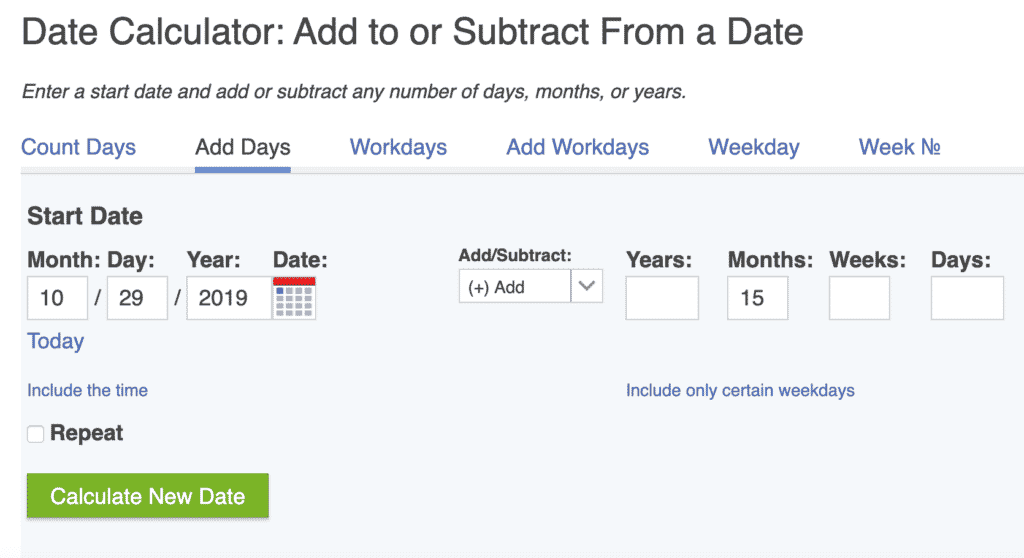

For example if you are 50 years old with 18 year of service you can apply for a deferred retirement when you reach your MRA of 57 years old. Subtract 3 years 0 months and 0 days from the retirement date year-month-day in 2 in order to determine the beginning day of the three-year period. Follow our step-by-step How to Create a Retirement Estimate on myCalPERS PDF guide to get your estimate.

How does inflation impact my retirement income needs. Federal Employees Retirement System FERS The Federal Employees Retirement System FERS was established by Public Law 99-335 in Chapter 84 of title 5 US. Are considering disability benefits within the next 12 months.

We assume that you have worked and paid Social. For example you are. Reserve component retirementthis pay is offered after 20 years of military service but is based on a points system which can include points for the following.

Get the most out of your federal retirement benefits by taking advantage of the FERS resources created by Micah Shilanski CFP and the team of independent financial advisors at Shilanski Associates Inc. You can contact them for help with your federal retirement benefits. The beginning date of Jerrys three-year.

Please visit our 401K Calculator for more information about 401ks. If youve retired from the federal government or plan to get to know the Office of Personnel Management OPMs retirement services. If a Federal or Postal employee becomes medically disabled disability retirement must be looked upon as an investment and as a rightful benefit earned by his or her service to the.

IRA and Roth IRA. Certain other Federal employees not covered by FERS have the. But you could also qualify if you are at least age 60 at retirement with 20 years of service or be at least age 62 with 5 years of service.

Are a multiple service member combined State Employees Retirement System SERS covered employment with PSERS employment and considering retirement within the next 24 months. My Annuity and. This means you must have 30.

Most new Federal employees hired after December 31 1983 are automatically covered by FERS. If you are younger than age 62 your pension multiplier would be 1. Should I convert discretionary expenses to savings.

Code and effective January 1 1987. Causation in a Federal Disability Retirement Case The Covid-19 Nexus in a Federal Employee Disability Retirement Claim. Yes you must be in the FERS Retirement system to get the FERS Supplement.

Log in to myCalPERS to estimate your retirement benefits using the latest data reported by your employer. Learn about retirement options. Federal Employee Retirement Planning and Management.

In the United States Social Security is the commonly used term for the federal Old-Age Survivors and Disability Insurance OASDI program and is administered by the Social Security Administration. Click here for a 2022 Federal Tax Refund Estimator. In the US the traditional IRA Individual Retirement Account and Roth IRA are also popular forms of retirement savings.

The original Social Security Act was enacted in 1935 and the current version of the Act as amended encompasses several social welfare and social insurance programs. The following two examples will illustrate. Generally payment you receive as a member of the military is taxed as wages.

Most new Federal employees hired after December 31 1983 are automatically covered by FERS. You have a benefit with the Internal Revenue Code Section 415b limit applied. Therefore additional categories of non-Army personnel from sister services or other federal agencies for example may be eligible for such.

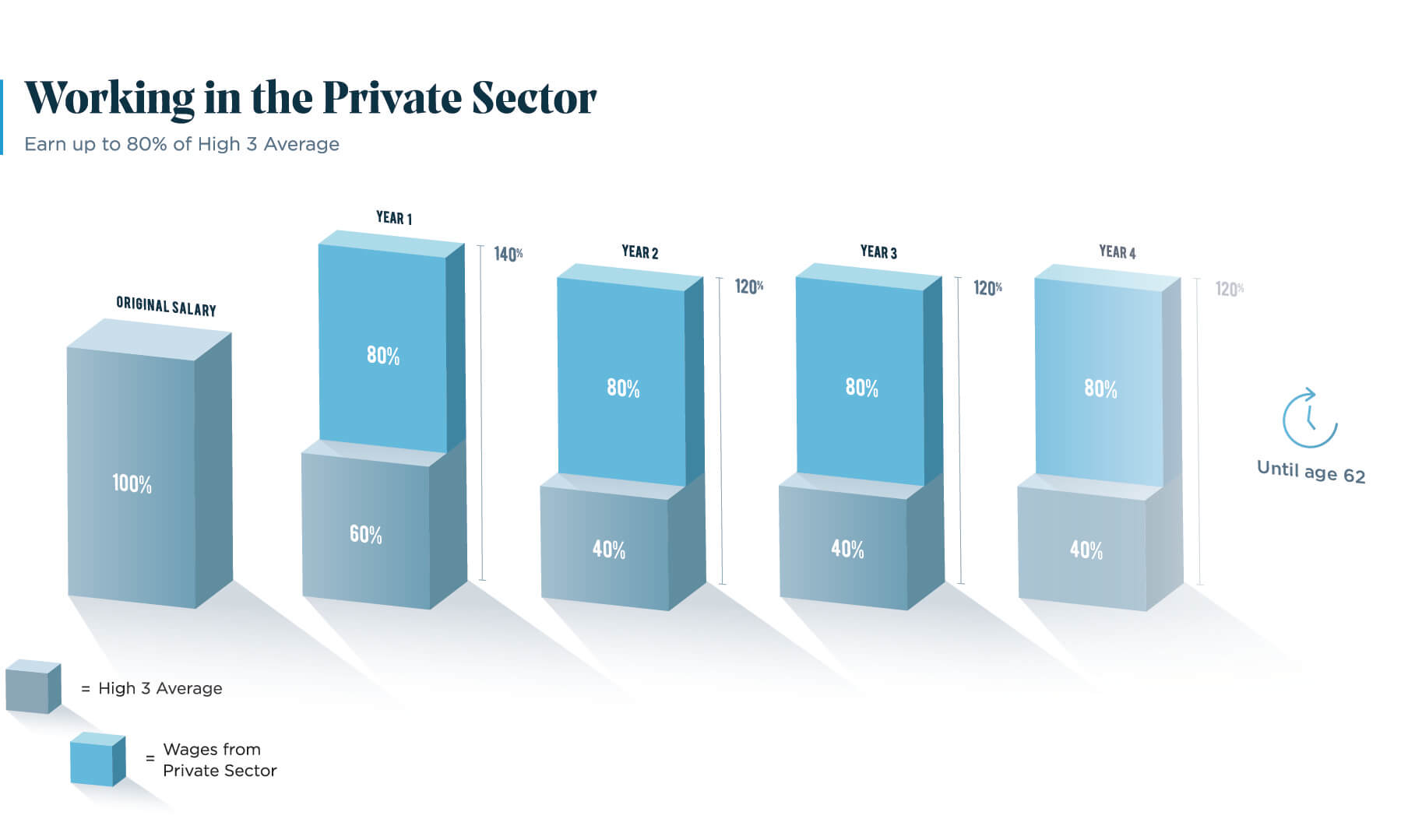

Use the Retirement Estimate Calculator to get an idea of what your monthly benefit might be. For easy numbers lets say your High-3 Salary is 100000. In the eyes of the federal government military retired pay is no different from any other form of income which means that you have to pay income tax on it.

Office of Personnel Management. That applies to spousal benefits survivor benefits and Social Security Disability Insurance SSDI as well as to retirement benefits. Skip Secondary Navigation In This Section.

For a regular Immediate FERS Retirement you must have reached your Minimum Retirement Age MRA and have at least 30 years of creditable service. You have 25 years of creditable service.

Disability Retirement The Western Conference Of Teamsters Pension Trust

Permanent Disability Benefits Worksafebc

Quick Calculator Social Security Disability Social Security Benefits Financial Calculators

How To Calculate Tube Feed Rate Cheat Sheet Feeding Tube Feeding Tube Awareness Feeding Tube Diet

Pin On Insurance

Converting Cpp Retirement To Cpp Disability What You Need To Know Resolute Legal Disability Lawyers

How Do I Calculate Fers Retirement With A Calculator Federal Employment Law Firm Of Aaron D Wersing Pllc

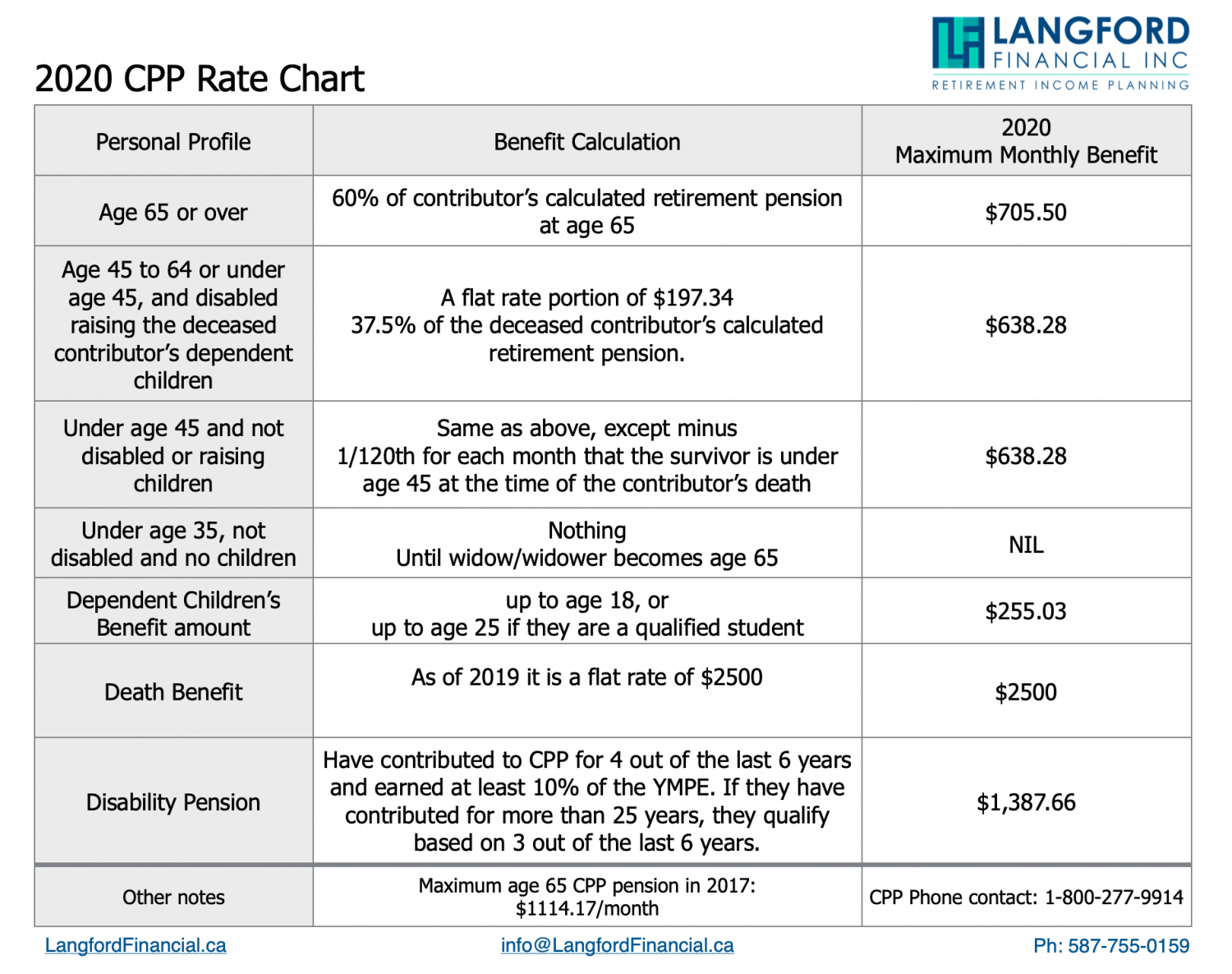

Cpp Benefits For Widows Widowers Children Amp The Disabled

10 Brilliant Budget Trackers For Your Bullet Journal Bullet Journal Budget Money Makeover Bullet Journal

Fers Disability Retirement Calculator How Much Opm Pays

This Social Security Planner Page Explains When You May Have To Pay Income Taxes On Your Social Security Benefits Income Tax Income Social Security

For All Your Questions And Concerns About Ssi And Ssdi Benefits Contact Disabil Social Security Disability Social Security Disability Benefits Social Security

How Your Pension Is Calculated Wise Trust

Mortgage Application Checklist Mortgage Pre Approval Real Estate Buyer Tips Editable Loan Officer Template Home Loans Realtor Flyer

All About Fers Disability Retirement Youtube

Pin On Disability Benefits

For All Your Questions And Concerns About Ssi And Ssdi Benefits Contact Disabil Social Security Disability Social Security Disability Benefits Social Security